AI operating system for commercial real estate

Turn your commercial properties into live, AI-priced, continuously tradable digital assets.

AgoraCRE builds real-time digital twins, automates pricing and leasing with AI, and unlocks fractional liquidity so asset owners get speed, transparency, and control without changing brokers or managers.

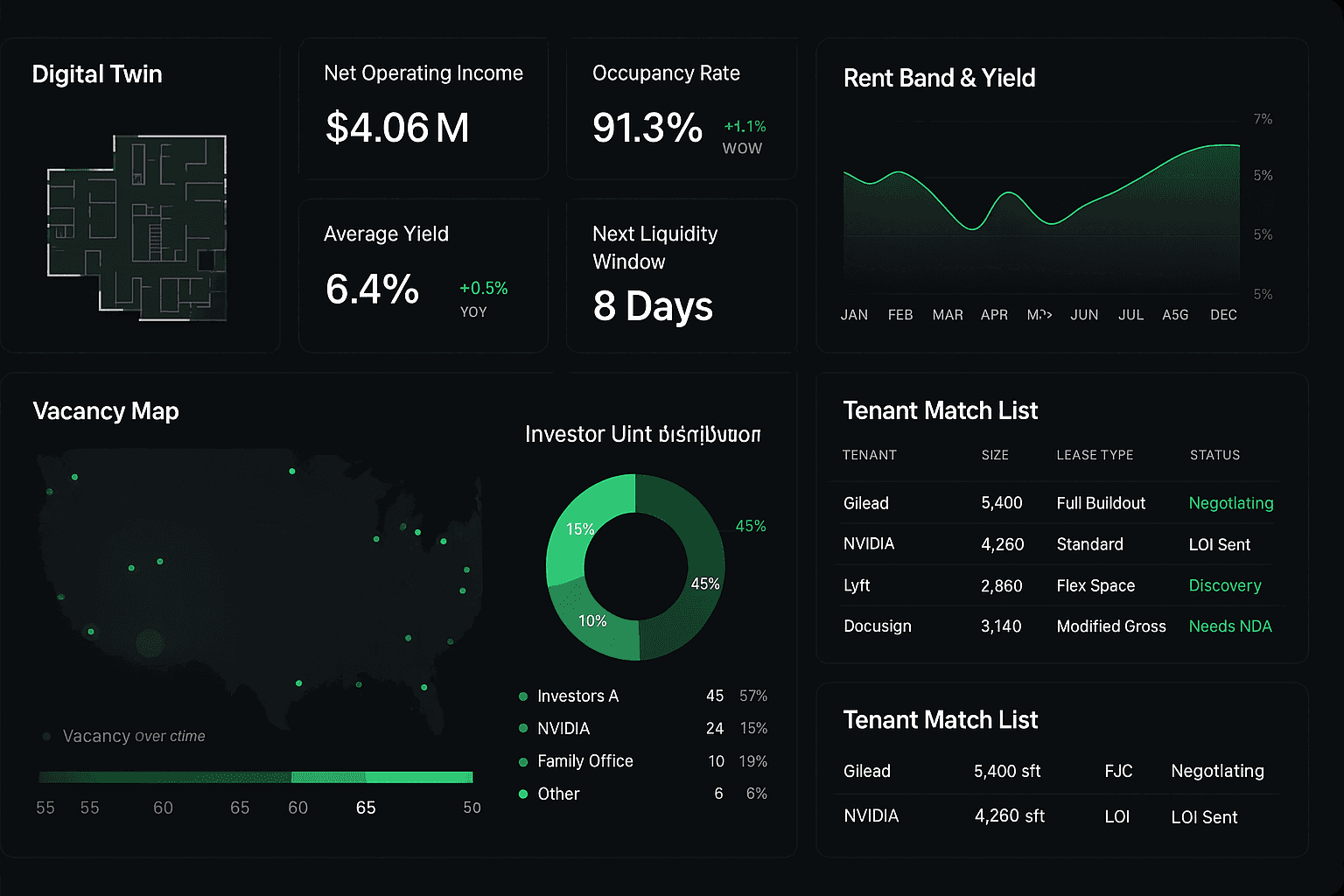

Portfolio overview

Live digital twin

NOI (run-rate)

$4.06M

Occupancy

91.3% +1.1%

Next liquidity window

8 days

Why the current stack feels so painful

The experience is broken today.

If you manage commercial properties, you probably live this every quarter. Nothing moves as fast as your capital or risk profile needs. A single vacancy or rate change turns into a multi-week scramble while spreadsheets, email chains, and broker calls try to catch up.

- Leasing cycles start with hunting for old decks, rent rolls, and “version_final_really_final.xlsx”.

- Pricing is stitched together from partial comps, broker memory and whatever data is easiest to find.

- Liquidity usually means a six-to-nine month process to sell the entire asset.

What teams describe today

“We don't really have a live view. By the time we pull data, clean it, send it around and agree on a number, the market has moved and the tenant has three other options.”

Asset management feels like running a portfolio in slow motion: pricing decisions are episodic, tenant matching is manual, and liquidity only appears when a full sale is on the table.

It's not that the team is bad. The tools were built for one-off deals, not live digital twins, automated tenant matching, or fractional liquidity. AgoraCRE exists to give asset owners a different default.

AI advantage

AI that prices demand, not memory.

Every rent call today is stitched together from old decks, partial comps, and whatever data is easiest to find. AgoraCRE learns from live tenant behavior to price buildings as the market shifts — not months later.

- Learns from leasing velocity, tenant mix, demand signals, and exposure shifts in real time.

- Generates true fair-value rent bands instead of static comp tables that go out of date the moment they're emailed.

- Flags mispriced space instantly, before vacancy quietly eats into NOI.

Teams stop guessing. Leasing stops reacting. Pricing becomes continuous — like a live market, not a quarterly project.

Digital twin engine

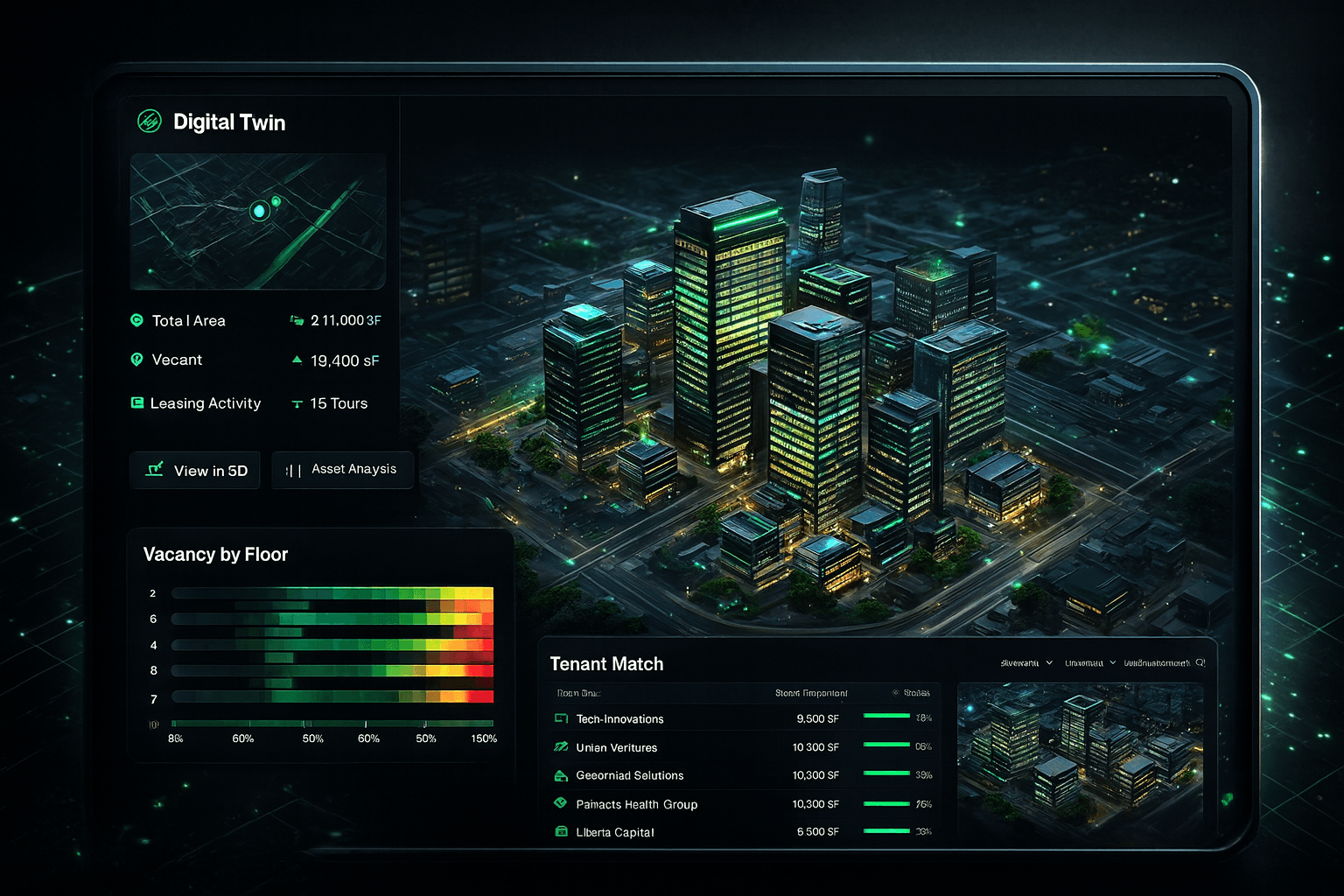

One live model for each building, not ten static files.

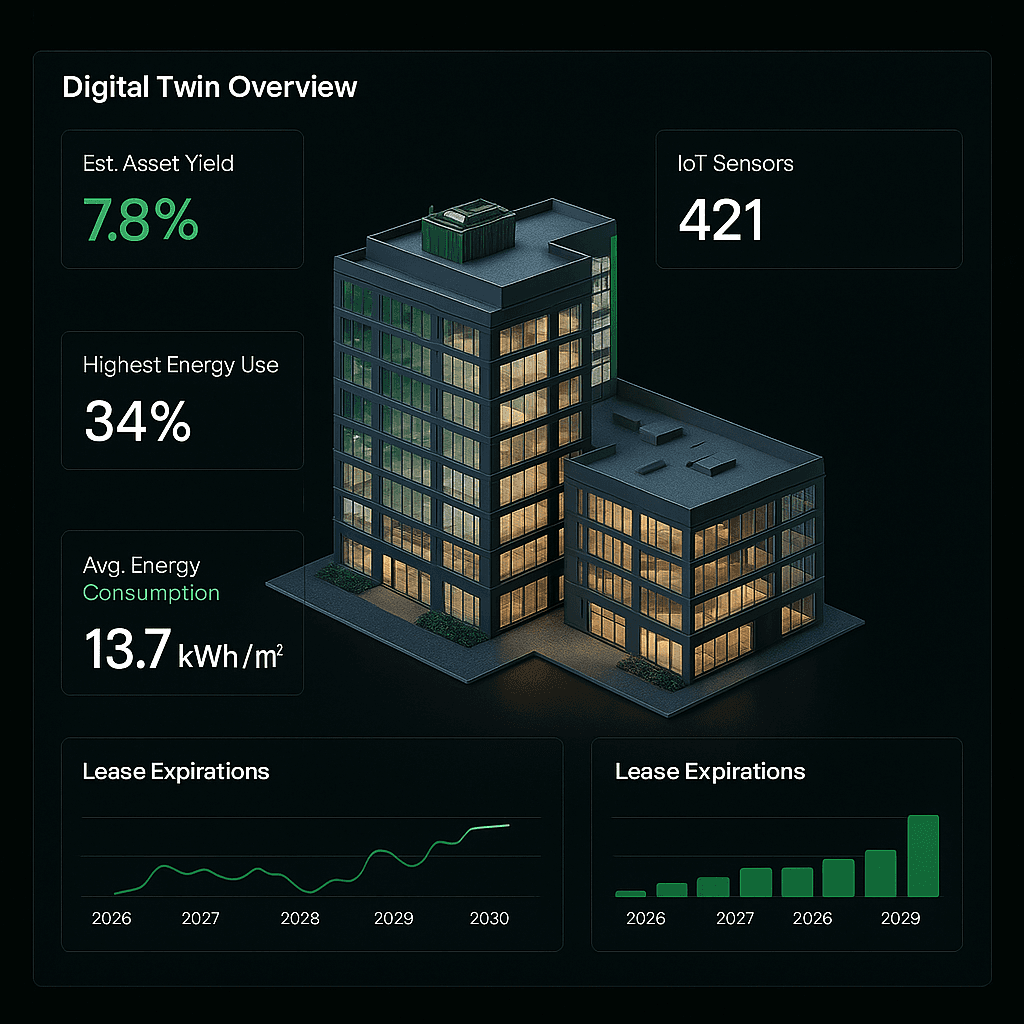

Each building gets a live digital twin that learns from leasing behavior, demand shifts, IoT signals, and operational metrics. The twin becomes the single place where pricing, exposure, and risk are calculated in real time.

- Predictive yield and fair rent bands updated as tours, proposals, and signed leases hit the system.

- Live energy and occupancy signals surface under-performing floors, buildings, or tenant mixes before they show up in NOI.

- Real-time exposures by tenant, sector, and geography so investors and credit teams see the same picture as asset management.

- Scenario layers for “what if we reprice this stack today?” without breaking anyone’s spreadsheet or reporting pipeline.

Instead of rebuilding models for every board pack or capital event, the twin is always on. Teams log in and see the same live view of value, risk, and opportunity.

That means fewer one-off projects, fewer surprises at investment committee, and a portfolio that reacts to the market in days instead of quarters.

Fractional liquidity

Built for programmatic exits, not one-off sales.

Instead of waiting for a buyer for the entire asset, AgoraCRE lets you define liquidity windows and fractional slices tied to the digital twin. You decide what's on the shelf each month.

Programmable windows

Set recurring monthly or quarterly windows for partial exits, aligned with your fund strategy and risk profile.

Investor-ready slices

Define units by yield, exposure, or geography so investors can buy into a clear slice of the portfolio.

On-chain optional

Keep it on your own cap table or surface to tokenization rails when regulation and partners are aligned.

Pricing

Priced like software, not like a transaction fee.

Today you pay chunky brokerage, appraisal, and advisory fees every time you want to make a move. AgoraCRE is a predictable platform fee that lets you make more, smaller, smarter moves — without waiting for a full sale or major event.

What you pay today

- • 3–6% broker fees on major sales or recapitalisations.

- • One-off appraisal and consulting fees for each event.

- • Internal team time spent on analysis and coordination.

- • Vacancy and mis-pricing while you wait for process.

With AgoraCRE

- • Simple platform fee, aligned to assets on the system.

- • No extra charge for running new scenarios or repricing.

- • Liquidity windows and tenant matches included by default.

- • Fewer large fees to intermediaries, more control kept in-house.

Pilot portfolio

$4,000 / month

Up to 5 assets, full digital twin, AI pricing, and liquidity windows. Designed to prove impact on one slice of your portfolio.

Platform rollout

Custom, starting below 10 bps AUM

Volume-based pricing for multi-asset portfolios. Typically replaces a mix of point tools and part of external advisory spend.

Why this is better: instead of paying high, episodic fees whenever you want to act, you pay a predictable software-style fee for always-on pricing, tenant matching, and liquidity. The upside from better timing and lower vacancy usually dwarfs the platform cost.

Early access cohort

Start pricing your portfolio in a different way.

The first cohort focuses on office and mixed-use assets with recurring leasing decisions. A small, closely supported group to prove faster leasing cycles, tighter pricing bands, and real liquidity windows.

Share a few details and the team will coordinate a short working session to see if your portfolio fits the current pilot.

No extra cost for pilot participants. The goal is to prove impact and workflow fit, not charge platform fees on day one.

Social proof

Teams don't want another dashboard. They want decisions.

These are fictionalised voices, stitched from conversations with asset owners, leasing teams, and portfolio managers we spoke to while shaping AgoraCRE. The workflows are real — only the names have changed.

“For the first time we can answer ‘what if we reprice this building today?’ without spinning up a mini-project.”

Director of Asset Management, 12-asset office portfolio

“Vacancy used to creep up on us. Now my weekly review starts with a single view of exposure, rent bands, and matchable demand.”

Leasing Lead, national industrial REIT

“Liquidity windows went from abstract to concrete. We finally know what could actually trade in the next 10 business days.”

Portfolio Manager, alternatives fund

Early user interest from: